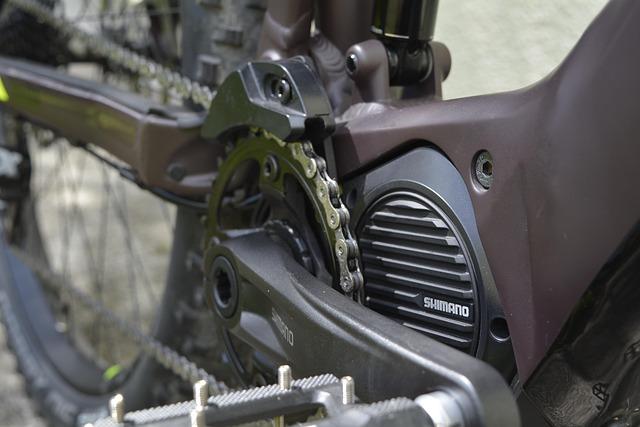

Shimano Reports Growth in Bike Component Sales for First Time Since 2022

In a promising turn for the cycling industry, Shimano Inc. has announced a notable increase in bike component sales, marking the first growth in this sector since 2022. Amid ongoing global economic uncertainties and shifting consumer preferences, the company’s latest financial results reflect a resilient demand for cycling products. Shimano’s positive sales trajectory not only signals a recovery for the brand but also hints at a revitalization within the broader bicycle market as enthusiasts and casual riders alike continue to embrace cycling as both a recreational activity and a sustainable mode of transportation. As Shimano navigates through the complexities of the post-pandemic landscape, industry experts are weighing the implications of this growth and what it could mean for the future of cycling.

Shimano Sees Significant Increase in Bike Component Sales Amidst Market Recovery

In a notable turnaround, Shimano has reported a substantial rebound in bike component sales, marking the first significant growth since 2022. This upswing can be attributed to various factors that have collectively contributed to the revival of the cycling market. Increased demand for cycling as a sustainable mode of transportation, coupled with a resurgence in recreational biking, has energized retail environments, leading to enhanced consumer interest. Key drivers of this growth include:

- Heightened awareness of eco-friendly transportation alternatives.

- Government initiatives promoting cycling infrastructure.

- The release of innovative products catering to diverse cycling needs.

- Consumer eagerness to invest in outdoor activities.

Additionally, Shimano’s strategic collaborations with manufacturers and retailers have allowed for better inventory management and distribution efficiency. This has enabled the company to meet the burgeoning consumer demand while navigating supply chain fluctuations. A recent analysis of sales figures reveals a sharp contrast to previous years, with the following breakdown illustrating the year-on-year performance:

| Year | Sales Growth (%) |

|---|---|

| 2022 | -12% |

| 2023 | 18% |

Analysis of Key Factors Driving Shimano’s Sales Growth and Industry Trends

Shimano’s recent surge in bike component sales can be attributed to several key factors that reflect broader industry trends. A resurgence in outdoor activities post-pandemic has fueled demand for cycling as both a recreational and sustainable mode of transportation. The increased popularity of e-bikes, which often utilize Shimano’s innovative components, has also played a significant role in this growth. Moreover, enhanced marketing strategies targeting younger demographics, alongside collaborations with major bike manufacturers, have broadened Shimano’s consumer base. This multifaceted approach has ensured that Shimano not only captures existing market interest but also stimulates new demand.

Furthermore, global supply chain improvements have allowed Shimano to better meet consumer needs without significantly increasing prices. The company’s commitment to sustainability, evidenced by recyclable materials in their products, aligns with the growing consumer preference for eco-friendly options. Examining the data highlights key segments that are pushing sales forward:

| Market Segment | % Growth YoY |

|---|---|

| Road Bikes | 15% |

| Mountain Bikes | 10% |

| E-Bikes | 25% |

| Hybrid Bikes | 12% |

These statistics underscore the rising preferences within specific segments, suggesting that Shimano’s strategic focus on e-bikes and performance-enhancing components is well aligned with emerging trends in cycling. As investments in infrastructure for biking continue to expand globally, Shimano is poised to strengthen its market position, further enabling a cycle of innovation and growth.

Recommendations for Retailers to Leverage Shimano’s Resurgence in the Cycling Market

As Shimano experiences a significant resurgence in the cycling market with rising bike component sales, retailers have a unique opportunity to capitalize on this momentum. To effectively leverage Shimano’s renewed popularity, retailers should consider the following strategies:

- Stock the Latest Shimano Innovations: Ensure that your inventory includes the latest Shimano components and bikes. Offering cutting-edge products will attract cycling enthusiasts and position your shop as a go-to destination for quality cycling gear.

- Educate Your Staff: Equip your sales team with in-depth knowledge about Shimano products. A knowledgeable staff can provide valuable insights and recommendations, enhancing the customer experience and driving sales.

- Host Community Events: Organize cycling events or workshops featuring Shimano products to engage with local cyclists. This not only promotes the brand but fosters community ties and brand loyalty.

Furthermore, retailers should actively promote Shimano products through marketing channels and online platforms:

- Utilize Social Media: Share user-generated content and testimonials featuring Shimano components on your social media platforms to create a buzz and encourage organic engagement.

- Offer Promotions: Develop limited-time discounts or bundle offers on Shimano products to encourage purchases and elevate foot traffic in-store.

- Collaborate with Influencers: Partner with local cycling influencers or content creators to feature Shimano gear, expanding your reach to their followers and potential customers.

| Strategy | Expected Outcome |

|---|---|

| Stock Latest Products | Increased Sales |

| Train Staff | Improved Customer Service |

| Host Events | Community Engagement |

| Promotions | Boosted Foot Traffic |

Closing Remarks

In conclusion, Shimano’s recent announcement of growth in bike component sales marks a significant turnaround for the company, signaling a potential recovery within the cycling industry. As consumers increasingly prioritize outdoor activities and sustainable transportation options, this uptick may reflect broader market trends favoring cycling. The company’s strategic investments and innovations in product development appear to be paying off, positioning Shimano to capitalize on the resurgence of interest in biking. As the industry looks to navigate ongoing challenges, including supply chain disruptions and fluctuating demand, Shimano’s positive trajectory offers a beacon of optimism for manufacturers and riders alike. The coming months will be crucial for the brand and the wider cycling market as they strive to maintain this momentum and further adapt to the evolving landscape of cycling.