Strava Sets Sights on Public Offering with $2.2 Billion Valuation

In a significant development for fitness enthusiasts and investors alike, Strava, the popular social networking platform for athletes, has reportedly been valued at an impressive $2.2 billion. The company, known for its innovative tracking and community engagement features that cater to runners, cyclists, and outdoor adventurers, may soon open its doors to public investment. Sources indicate that Strava is actively exploring options for an Initial Public Offering (IPO), a move that could not only broaden its financial foundation but also enhance its ability to expand and innovate within the competitive landscape of fitness technology. As the anticipation builds, athletes and investors are keenly watching to see whether Strava’s ascent will translate into shared opportunities on the stock market.

Strava’s Rapid Growth Elevates Its Market Valuation to $2.2 Billion

Strava, the popular fitness tracking platform, has witnessed an impressive surge in its market valuation, now standing at $2.. This leap is largely attributed to the platform’s rising user engagement and the expansion of its premium subscription services. As millions of athletes and fitness enthusiasts flock to Strava to share their workouts, the company continues to enhance its features, catering to both casual users and serious competitors. The latest updates have focused on integrating community challenges and personalized coaching, which have contributed to a spike in user retention and brand loyalty.

Given this robust growth, speculations are mounting about a potential public offering that would allow investors to buy shares of Strava. This move could democratize ownership of the platform, enabling everyday users and fitness advocates to contribute to its future direction. Industry analysts point to several key factors that support Strava’s valuation and possible IPO:

- Growing User Base: Over 100 million registered users globally.

- Subscription Revenue: Substantial growth in premium memberships boosts financial stability.

- Innovative Features: Continuously rolling out enhancements to maintain user engagement.

Impending Share Availability: What Potential Investors Need to Know

Recent reports indicate that Strava, the popular social network for athletes, is currently valued at an impressive $2.2 billion. As the company explores the possibility of making shares available to the public, potential investors should remain vigilant and informed about this opportunity. Understanding the dynamics of Strava’s business model and its user engagement metrics will be essential for evaluating the potential success of this investment.

Before making any decisions, consider these key factors:

- User Base Growth: Strava boasts millions of active users, with notable growth over the past few years.

- Market Position: The company is a leader in fitness tracking and social engagement within the sports community.

- Revenue Streams: Strava generates revenue through subscription services, partnerships, and potential new monetization strategies.

| Key Metric | Value |

|---|---|

| Total Users | Over 100 million |

| Annual Revenue | Estimated $100 million |

| Year Founded | 2009 |

Navigating the Fitness App Landscape: Analyzing Strava’s Competitive Edge

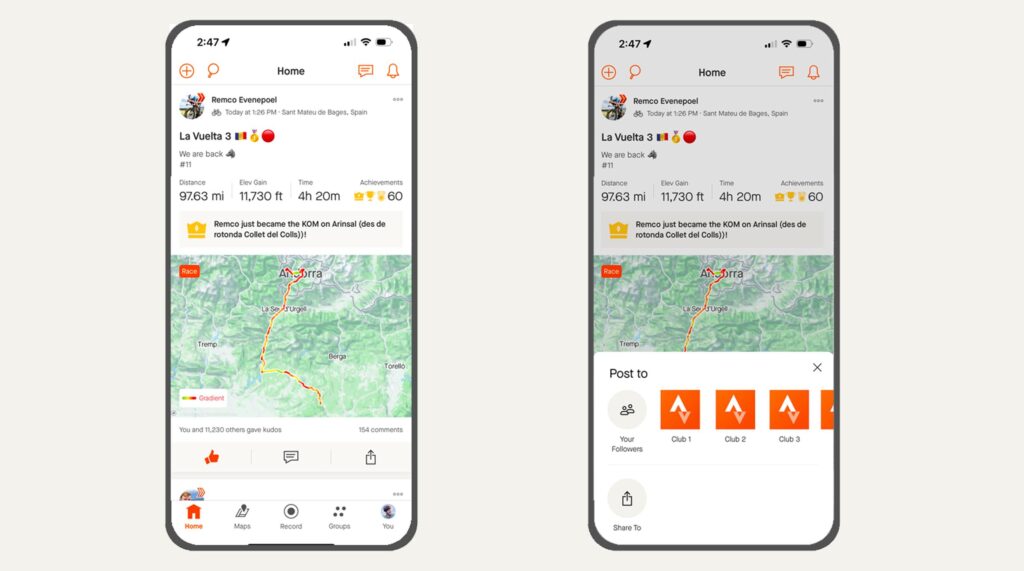

As Strava gears up for potential public listing, the app’s unique position within the crowded fitness landscape underscores what sets it apart from competitors. Unlike many fitness apps, which focus solely on tracking workouts, Strava fosters a vibrant community of athletes who share their journeys, achievements, and challenges. This emphasis on social interaction encourages user engagement, making Strava not just a fitness tracker but a social platform for athletes. Key aspects contributing to its competitive edge include:

- Robust Community Engagement: Strava’s social features, such as clubs, challenges, and leaderboards, motivate users through friendly competition and camaraderie.

- Diverse Features: From cycling and running to swimming, Strava supports a wide array of activities, catering to various fitness enthusiasts.

- Data-Driven Insights: Advanced analytics and performance metrics help users track their progress and set achievable goals.

- Integration with Wearables: Compatibility with multiple devices enhances user experience by allowing seamless data syncing.

Moreover, as the fitness app landscape continues to evolve, Strava’s focus on user-generated content creates a rich trove of data, facilitating improvements and innovations that cater directly to user needs. This commitment to a personalized experience not only enhances retention rates but also attracts new subscribers, thereby improving the app’s monetization potential. As Strava continues to grow, it demonstrates a compelling business model, paving the way for robust financial prospects that could further bolster its valuation:

| Feature | Strava | Competitor A | Competitor B |

|---|---|---|---|

| Community Engagement | High | Medium | Low |

| Diverse Activities | Yes | Yes | No |

| Data Analytics | Advanced | Basic | Intermediate |

| Wearable Integration | Wide | Narrow | Limited |

In Conclusion

As Strava continues to solidify its position as a leader in the fitness tracking and social networking space, its recent valuation of $2.2 billion underscores the platform’s potential for growth and innovation. With reports suggesting that the company may soon offer shares to the public, many investors will be keenly watching for developments that could open the door to ownership in this dynamic brand popular among athletes and fitness enthusiasts alike. As Strava navigates this pivotal moment in its business journey, stakeholders will be eager to see how the company capitalizes on its growing user base and market opportunities. Whether you’re a seasoned investor or a newcomer intrigued by the fitness-tech landscape, Strava’s potential IPO could represent an exciting opportunity as it gears up for the next phase of its evolution. Stay tuned for updates on this unfolding story, as the fitness community and investors alike await further insights into Strava’s plans for the future.